Fiscal policy, one of the key tools of economic governance, plays a critical role in shaping the economic trajectory of a nation. It refers to the use of government spending and taxation to influence economic activity. The Impact of Fiscal Policy on Economic Growth By adjusting the levels and types of taxes and controlling public expenditure, fiscal policy aims to stabilize the economy, promote growth, and reduce unemployment. Understanding the effects of fiscal policy is crucial for policymakers, businesses, and citizens alike, as it directly impacts everything from inflation rates to the availability of jobs.

This article will delve into the role of fiscal policy in promoting economic growth, the mechanisms through which fiscal policy works, and the challenges faced by governments in implementing effective fiscal measures.

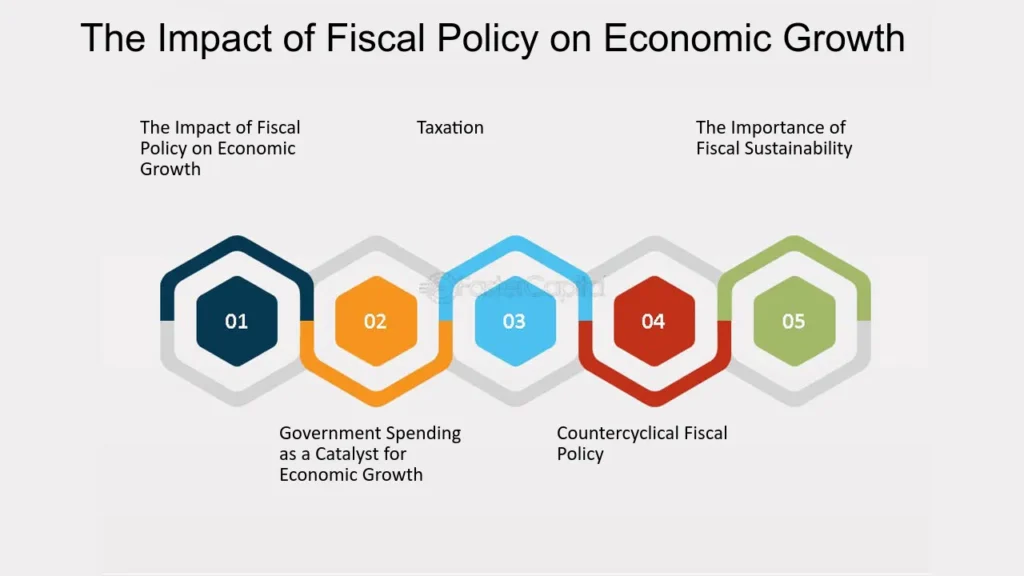

The Mechanisms of Fiscal Policy (The Impact of Fiscal Policy on Economic Growth)

Fiscal policy primarily operates through two main mechanisms: government spending and taxation. These elements are adjusted in response to current economic conditions, and their effects can vary based on the fiscal strategy employed.

- Government Spending

Government spending is a powerful tool used to stimulate economic activity, particularly during times of recession or slow economic growth. Public sector investments in infrastructure projects, education, healthcare, and social programs can inject money into the economy, increasing demand for goods and services. By expanding public expenditure, governments can directly create jobs and support industries, which in turn promotes economic growth. For instance, building new roads, bridges, or schools provides employment and also creates a multiplier effect—where the initial spending leads to further economic activity as workers and contractors spend their wages in local economies. - Taxation

Taxes are another lever used to influence economic activity. Lowering taxes increases disposable income for individuals and businesses, stimulating consumption and investment. This is especially important during economic downturns, where boosting aggregate demand can help spur growth. Conversely, raising taxes can be a way to cool down an overheating economy or to reduce a growing fiscal deficit. However, the effectiveness of tax changes depends on the elasticity of consumer and business spending, meaning how responsive they are to changes in income and tax rates.

Governments often employ different types of fiscal strategies, including expansionary and contractionary policies, depending on the economic environment:

- Expansionary Fiscal Policy: This is typically used in times of economic downturn, where the government increases spending and/or cuts taxes to boost economic activity. By stimulating demand, expansionary fiscal policy aims to reduce unemployment and revive growth.

- Contractionary Fiscal Policy: On the other hand, contractionary fiscal policy is used when the economy is overheating—often marked by high inflation and unsustainable growth. In such cases, the government may reduce spending and increase taxes to curb inflation and stabilize the economy.

The Role of Fiscal Policy in Economic Growth

The relationship between fiscal policy and economic growth is multifaceted. When implemented effectively, fiscal policy can create a positive environment for sustainable growth. Here are a few key ways fiscal policy influences economic growth:

- Stimulating Demand and Employment

During times of recession, consumer confidence drops, leading to reduced consumption and investment. Fiscal policy helps counteract this decline by increasing government spending and reducing taxes, thus injecting money into the economy and supporting both demand and job creation. Infrastructure projects, in particular, can have long-term benefits for the economy, laying the groundwork for future productivity gains and improved efficiency. - Encouraging Investment

Tax cuts for businesses can provide them with more capital to invest in expansion, research and development, and hiring. Furthermore, government spending on infrastructure and education can improve the environment for private-sector investment by reducing costs and improving the productivity of the workforce. - Reducing Unemployment

By stimulating demand and investment, fiscal policy can reduce unemployment. When businesses experience higher demand for their products and services, they may need to hire more workers, thereby reducing the unemployment rate. Additionally, targeted social programs and government spending in areas like job training can help individuals who are unemployed gain new skills, thus improving their employability. - Reducing Income Inequality

Fiscal policy also plays a role in addressing inequality through progressive taxation and social welfare programs. Progressive tax systems, where higher incomes are taxed at higher rates, help redistribute wealth and ensure that the benefits of economic growth are shared more equitably across society. Public spending on education, healthcare, and social security can also reduce inequality by providing services that enhance the well-being of lower-income households.

Challenges in Implementing Fiscal Policy

Despite its potential, fiscal policy faces numerous challenges that can affect its effectiveness and outcomes. Some of these challenges include:

- Budget Deficits and Public Debt

One of the major concerns in using fiscal policy, especially expansionary policies, is the risk of creating budget deficits and rising public debt. When governments increase spending or cut taxes without corresponding revenue increases, it can lead to a growing fiscal deficit. Over time, this debt accumulation can create financial instability, increase borrowing costs, and reduce the government’s ability to respond to future economic crises. - Time Lags

Fiscal policy often suffers from time lags, meaning there can be delays between when a policy is enacted and when its effects are felt in the economy. For example, it may take months or even years for a government-funded infrastructure project to get off the ground. Similarly, tax cuts may not immediately lead to increased consumer spending, as households may choose to save rather than spend. These time lags can make fiscal policy less responsive to rapidly changing economic conditions. - Political Constraints

Fiscal policy is also influenced by political considerations. Government decisions on taxation and spending often involve trade-offs, with different political parties or interest groups pushing for their preferred outcomes. Political gridlock, ideological divisions, or vested interests can lead to inefficient policy decisions or delays in implementation. Furthermore, governments may avoid necessary fiscal adjustments (like raising taxes or cutting spending) due to the fear of political backlash. - Global Economic Conditions

In today’s interconnected global economy, national fiscal policies are also impacted by external factors. Economic crises, trade disruptions, or global financial market shifts can affect domestic economies, sometimes rendering domestic fiscal policy less effective. For example, during the global financial crisis of 2008, many governments faced difficulty in stimulating their economies due to interconnected banking systems and cross-border capital flows.

Conclusion

Fiscal policy is a critical tool in managing economic growth, stabilizing economies, and addressing unemployment and inequality. By carefully balancing government spending and taxation, fiscal policymakers can foster an environment that supports sustainable economic development. However, the effectiveness of fiscal policy depends on a variety of factors, including the broader economic environment, the timeliness of policy interventions, and political will. The complexities of implementing fiscal policy, particularly in times of global economic uncertainty, make it a delicate balancing act. Despite these challenges, when used wisely, fiscal policy remains one of the most powerful levers governments have for ensuring long-term prosperity and economic stability.

Tools to try

Budgeting and Forecasting Tools:

Software like OpenGov and GovInvest assists policymakers in creating transparent budgets, analyzing fiscal trends, and forecasting economic outcomes.

Another tool you can use is one that can help you achieve economic growth. there is another article about Economic decision-making https://botanguide.com/economics-policy-analysis-navigating-the-complexities-of-economic-decision-making/

The Impact of Fiscal Policy on Economic Growth 2025: Strategies for Stabilizing Economies